A New Brand Day

- theindustrysexpertresource

- TheTruthIsYourGreatestAsset

- #artappraisal

- TheValueOfKnowing

- ArtAdvisor

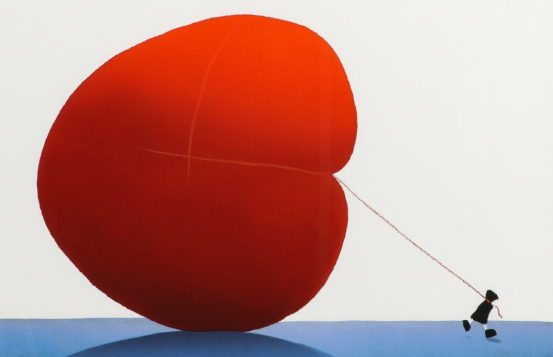

Springtime is a season of renewal and rejuvenation- and in this same spirit, Art Peritus has undergone a transformation as well! After months of meticulous crafting, we’re thrilled to unveil [...]