From passion assets to planned giving does estate planning affect the growth and development of a collection?

The Art of Collecting

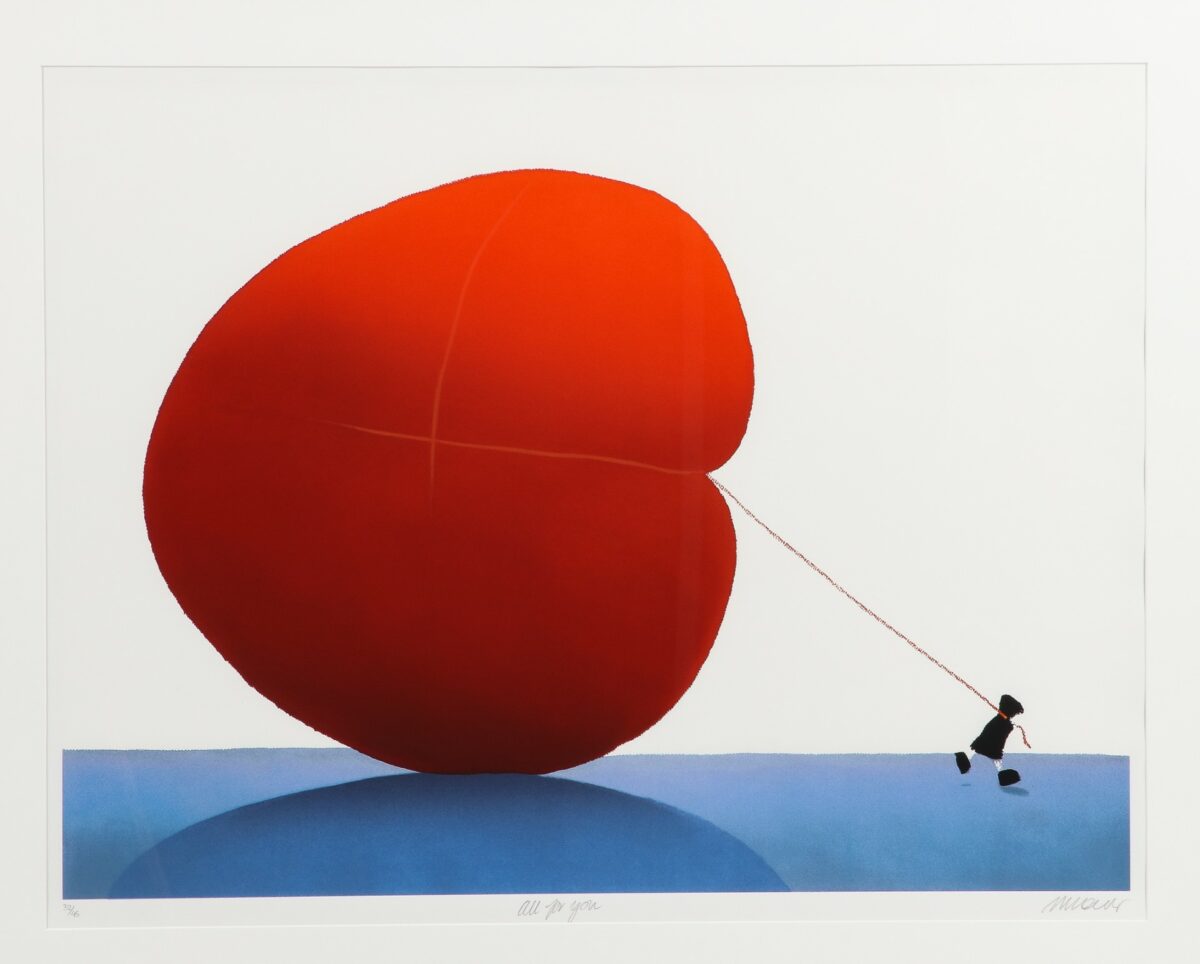

A variety of factors drive collectors to collect. Perhaps its investment, notoriety or by inheritance. Regardless of if they are collecting art, wine, jewelry, baseball cards or vintage autos, arguably the greatest force behind any serious collector is their passion.

At least, at first.

As collectors build their collections, they inevitably discover more about the items they are seeking, and their interests deepen and evolve. They may focus on specific genres, eras, or artists, creating a collection with a certain theme or meaning, or they may broaden their scope to incorporate greater variety to reflect their personality or lifestyle.

There is no “right way” to collect. However, there are a myriad of reasons why a collector should think about what will happen to their collection once they are gone.

An Investment in the Future

For many collectors, a high-value collection represents a joyful investment in the future. While appraisal values may rise and fall with the tide of fluid markets, those who collect passion assets are still able to appreciate and enjoy their investments throughout their lives while remaining confident that it will provide a valuable and worthy legacy to leave behind.

But the problem with passion is that it’s hard to pass on. The same is true with one’s passion assets.

Even in close-knit families where collecting is embraced generation after generation, it is easy to understand how heirs may not share the same tastes or interests for collected items. Inheriting a valuable collection is simply not the same as assembling it yourself, and minus the passion for the collection, its value defaults to its appraised market value.

This is why it is so essential for collectors to engage in estate planning as early as possible.

Leaving a Legacy

Although a collector, especially one that is young, may be loath to begin thinking about their inevitable passing, it is crucial that they consider the ultimate fate of their collection well in advance.

Not only does it help facilitate the bequest of the valuable items they’ve collected, but it may also help guide them in the growth and development of their collection.

For example, if a collector has multiple heirs, they may not wish to “break up” their collection by distributing its parts to different beneficiaries. And even if they do, they may find it impossible to do so equitably, due to the variance in value of some pieces. If the bulk of the value in a collection is held within one or two pieces, how can it be evenly (and amicably!) distributed between three heirs?

Having no estate plan in place is easily the worst scenario. In this situation, a collection is likely to fall under the control of an executor who may choose to liquidate the collection altogether to allow for an equitable distribution of assets. Selling a collection at auction in the interests of expediency could very well minimize the exit value of many objects. Further, sales of tangible assets will be subject to capital gains taxes at a rate of 28%, whereas items bequeathed directly to heirs will not trigger estate taxes (unless they turn around and sell them).

Planned Giving

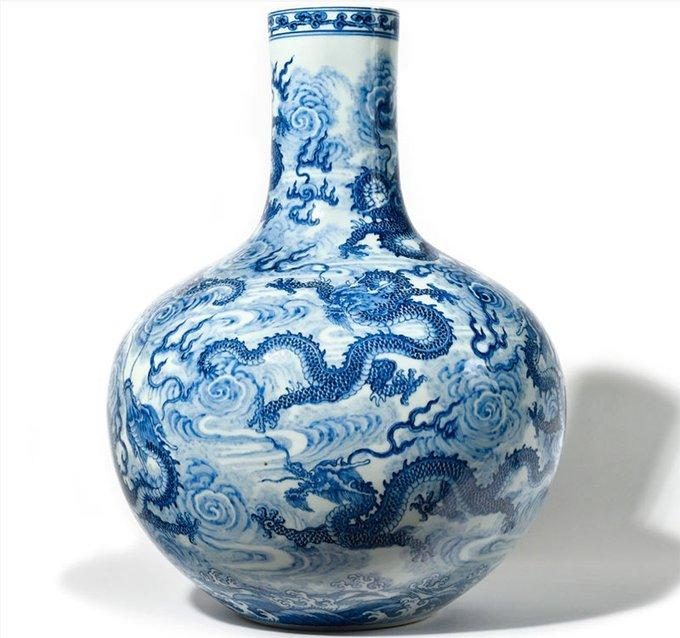

Perhaps a collector knows a single piece, or their entire collection would be appreciated by a broader audience. Maybe they have a strong relationship with an institution with the same subject matter focus or that is committed to their same philanthropic values. Having invested much time and capital in obtaining their assets of passion, the consideration of donation and Planned Giving is an important one.

Any major gift can be an effective way of not only circumventing capital gains and estate taxes, but it may also entitle the estate to claim a charitable tax deduction. However, there are limitations to this process.

For example, a collection must be donated to a public charity that will use the items for non-commercial purposes, rather than to a private foundation. This can be problematic in that the terms of the donation may be more difficult to negotiate with a public entity than with a private foundation, especially if it is a foundation set up to administer the collection.

If the desire is to make one’s collection available for the public to enjoy, strict conditions must be placed on the collection to ensure that it remains intact and outlines what can and cannot be done with it in perpetuity.

The Advisory Advantage

In addition to consulting with a financial planner, collectors can avoid many of the pitfalls of passing on their passion assets with the aid of an art advisor who has expertise and experience navigating this kind of conversation. Collectors will inevitably need to have their tangible assets professionally appraised for both insurance and tax purposes. This is when consulting with a team like Art Peritus provides invaluable insight and can help direct collectors in the best way to grow, protect, and maintain their collection for both posterity and financial value.

An experienced consultant for example, may identify certain niche collecting markets that can encapsulate a collection, giving it form and shape for future acquisitions. This type of advisory relationship can help the collector continue to develop their collection in such a way that stays engaging, desirable and true to the passion that inspired them in the first place, whether it is ultimately sold or donated to charity.

An Art Consultant may even help forge connections with viable charities, and otherwise lay the groundwork for legacy giving that will protect the collection and its value once the collector is gone. It is estimated that art and passion asset collectibles comprise around 10% of the net worth of individuals worth $30M or more. Globally, that amounts to more than $3 trillion in privately held assets, nearly all of which have a value determined solely by market conditions.

Collecting passion assets may well begin as a fervent personal pursuit, but what happens to those assets in the end is something collectors truly need to consider, because it will likely affect the development of the collection itself.

#art #artcollector #artconsulting #artadvisory #passionassets #estateplanning #planninggiving #legacygiving #majorgifts #charitabledonation #estateappraisals #appraisals #artappraiser #artappraisals #collectionmanagement #passonyourpassion #fineart #jewelry #wine #artperitus